For this post we’re getting back to basics. Today’s topic is one that many of you may already understand. While Johnny and I are fortunate enough to be out of debt, we realize debt is a reality for many. And so we’d like to share one of the tools that helped us slay the Debt Monster.

I don’t know whether it’s the lack of financial education, the outrageous cost of higher education, our “biggie size that” American culture, or a combination of these and other issues that causes almost all of us to start out our adult life in the red. If you’ve never had any debt in your life, you’re basically a unicorn. When Johnny and I first started incurring debt, we didn’t like it one bit. But we had to pay for our degrees somehow. It seemed like the day of reckoning for the beginning of our payments (after graduation) was ages away. But come it did as we wondered how in all holy curse words we would go about starting a $20k loan payoff.

We had four different loans to pay off, and we needed a plan. Having recently read Dave Ramsey’s The Total Money Makeover, we had our marching orders, including the debt snowball plan. It played a star role in our Lifetime original movie The Debt Slayer Next Door, so naturally we’d like to share more about it.

The Debt Snowball Plan

So how do you get started? Do I really need to wait for it to snow? How cold will I get? Great(ish) questions! It’s actually really easy.

- Take a look at all your loans and order them from smallest to largest.

- Cut your unnecessary budget expenses and put aside as much money toward debt payoff as you can possibly spare.

- Pay the minimum on all loans, except your smallest.

- Use all extra monthly debt repayment money to put toward your smallest loan.

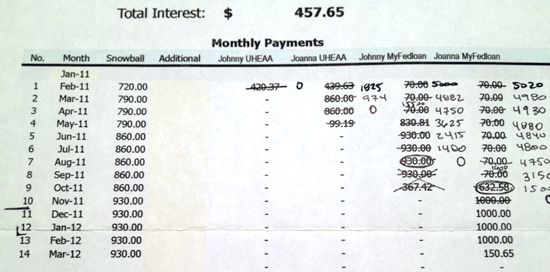

One of the coolest tricks to the debt snowball plan is how the payments compound (thus, the term “snowball”). Once you’ve paid off one loan, you take all the money you were putting toward paying it off and add it to the next loan. Once that next loan is paid off, you take all the money that was going toward that loan and put it toward the following loan. Here’s a real-life example from our very own debt snowball (that Johnny has nerdily saved as a keepsake):

Our very first debt snowball started with $400 total budgeted each month.

Our very first debt snowball started with $400 total budgeted each month.

A few months later, we pumped steroids into our snowball and upped the ante to $1000+/month.

A few months later, we pumped steroids into our snowball and upped the ante to $1000+/month.

The debt-snowball method was perfect for us. We took a hard look at our cash flow, our expenses, and our savings, and came up with an aggressive, yet doable, payoff timetable. And we saw results almost immediately, which helped keep us motivated. So motivated, in fact, that we sped up the process and started throwing even more money at it.

A few final thoughts:

- Conventional wisdom says to pay off the highest interest rate loans first in order to save money paid on interest. If you’re able to do that and stay motivated, that’s awesome. But for Johnny and me, seeing the fast progress on that smaller, first loan is what really got us fired up and kept us movin’ and groovin’.

- You don’t have to be perfect. Once you make a payoff plan, it’s okay if you have to deviate from it from time to time. Unexpected expenses arise. Life happens. But once things settle down, get back on that payoff horse and ride into the sunset. That’s a really weird sentence. Johnny must be rubbing off on me. 🙂

- Have an emergency fund. Dave Ramsey recommends having $1000 saved up before starting the debt snowball plan. That’s all Johnny and I had to begin with, and we tried to put a hundred dollars or so toward savings each month.

And that’s the debt snowball plan. If you’re paying off debt now, are you snowballing your payoff? What plan are you using to stay motivated in paying off your debt? Can I get any “amens” from fellow snowball worshipers in the house?

43 Comments

I didn’t use the debt snow ball method for my debt, I went by interest rate, which meant that I attacked my largest loan first. Fortunately, it’s almost gone, and soon I’ll be able to move on to my smaller loans, which will be far easier to get rid of than the big loan! I think the debt snow ball method is a great idea for people who are just learning about paying off debt, because you are rewarded for your efforts quicker.

It probably would have been worth noting that the interest rates between our four different student loans were within 1% to 2% of each other. Had there been more disparity between them, I think we might have reconsidered and done things like you. Congrats on getting that big one down! The smaller loans will be a piece of cake.

I’ve been paying off my student loans by interest rate. But it also helped that the loans with the largest interest rates were also my largest loans. I’m attacking them like crazy!

Awesome awesome. And that is helpful that you’ll have the big ones done first. “Attacking” and “crazy” usually don’t go well together in a sentence — unless we’re talking about debt. 🙂

We were using the snowball method, as we really needed to see the quick wins that Dave talks about, for encouragement purposes. But once we started tracking how much interest we were paying out, we switched to paying the highest interest loan first. It works well for us, but only b/c we’re totally committed to paying off the debt. If you’re still feeling a bit wobbly in the motivation/commitment arena, I would definitely go with the snowball.

Quick wins were important for us in the beginning. Had there been more disparity in our various interest rates, I think we would have done like you and switched to the highest interest loans next. After we rocked that first one, we were sold on knocking it all out.

Great recap!

We took a hybrid approach to the debt snow ball. We lacked the “gazelle” type intensity that Dave Ramsey preaches but we’ve made a lot of progress. What Ramsey recommends in his books really do help but there are varying levels of debt that people are in. It’s not a one size fits all. It does require some lifestyle changes, but in the end it’s worth it.

Good point. There are lots of different types of debt, circumstances, etc. and there’s certainly not one right option. At the end of the day, debt is debt is debt. And everyone should figure out how they can get rid of it most effectively and expeditiously.

So glad that the debt snowball method worked out so well for you! When my husband and I got married he was graduating the next day (yes we got married the day before his graduation) and I had 2 quarters if college left. He had $27,000 in school loan debt and I had about $6500 at the time. I had to take a $5500 loan for my last 2 quarters of school. The day I graduated we paid in full the $1000 loan that was part of the $5500 because it was the smallest. That got the snowball rolling. However, the husband had pesky 9.5% Sallie Mae loans while mine were all federal. We decided to attack those high interest loans and pay minimum on mine. We had some set backs such as it taking me 6 months I find a full time job. We also made some poor decisions buying new cars (negotiated great prices though cheaper than 2 year old lightly used vehicles), vacationing to Hawaii and Europe (I guess I don’t really regret those because we kept budget in mind and paid cash for them) and taking out the interest free $7500 loan from government to help with remodeling house when we bought it. We were able to pay off my husbands loans, buy 2 vehicles outright and I am now down to around $4,000. For the past 2 years we have been paying extra on my loan but only about $100. We have the savings to pay it off but we haven’t been able to be in agreement about it as I stay home with our daughter so we want an emergency fund of 6 months minimum monthly expenses. Also we have an extremely small house that will be really hard to fit another baby in so we would like to have 20% down on a house. I am trying to figure out extra ways to bring in income to help get rid of that pesky $4,000!

So awesome! Only $4000 left. We were confronted with the same situation near the end of our debt repayment where we had the money in savings to pay it off outright, but we opted to pay large chunks instead of paying it all down., especially since we didn’t want to dip into emergency funds. I think you’re making the right call. Congrats on all your progress!

I paid off my smallest loans first too, but I think conveniently they also had the highest interest rates. I had four separate student loan payments (thanks government for changing the process halfway through my education!) + an education line of credit. The student loans had the highest interest rates, so once I got them down to a few thousand, I paid them off with my line of credit, and now I just have that to pay that off. I’ve paid off over half my debt (originally about $40, 000) in just a couple of years! I am so ready to be debt free that I have no shortage of motivation to get it paid. If everything stays the same (i.e. I can make the same payments or more), I’ll be out by next Sept./Oct. Can’t wait!

Awesome work, congrats! $40k is a whole lotta money to attack in just a few short years. We were in the same boat with multiple student loan payments that were mostly distributed by the same lenders. It was a mess of a process for early-20-somethings to get our heads around.

Look forward to hearing your progress. Congrats again.

I’m using the debt snowball method. For me, motivation is very important and I small wins along the way to keep me going. It’s only been a few months, but I’m doing it and feel good about it.

It’s all about the small wins. And congrats on getting it started and documenting it on your blog.

We’ve sort of used this method, though I didn’t know there was a name for it. When Hubs and I graduated, he had no student loan debt (a unicorn!) and I had about $15k. I paid off the smallest loan first and early, and then put the extra toward my second, consolidated, loan. But then other expenses were coming (wedding, saving for a house) and since I was fortunate enough to graduate in the “good years” and my interest rate is only 1.9% AND is tax deductible, it didn’t make sense to sock extra money away there versus our mortgage or other loans we took on.

Since those early days, we’ve amassed a car loan and a home improvment loan. We just made the last car payment last month, and most of the extra’s being rolled into the home improvement loan to get that bad boy paid off (the rest is going into savings for an eventual new car).

A real life unicorn! Good for him. And that’s awesome that you guys were doing it without even knowing it. Smart cookies. Sounds like you’re making great progress and still focused on the goal at hand. Virtual high five!

This is a great overview. My wife and I just recently finished paying all of our loans with the interest rate method. We chose that method to save the most money because we were already as motivated as we could be and we didn’t need to see the little windfalls. That being said, I think in order to pay off debt you need to figure out what works best for you. It’s all personal preference and as long as it works, then that’s all that matters.

Way to make it work for you. We were total debt and finance novices, so we needed to see the victories. Had we been a little better versed in that world, we probably would have made the intuitive choice of paying the highest interest.

Best sentence ever!!!! “If you’ve never had any debt in your life, you’re basically a unicorn.” <-That needs to be a meme or something!

I'm kind of doing the debt snowball. I guess I'm making a bunch of snowballs, maybe I'm building a snowman? Instead of tackling my overall lowest debt first, I'm snowballing my private loans with a co-signer because my #1 priority is to get them off my loans. After I have my co-signed loans paid off, I'm moving on to snowballing my credit cards (if they're not paid off by the time I pay off my private co-signed loans). Then I'll pay off the one remaining private student loan without a cosigner, then snowball my federal loans lastly. I wish I could throw these snowballs in Sallie Mae's face when I'm done (because by the time that happens they'll be more like ice balls)!

This is how we attacked our student loans too! I agree on throwing the snowballs in Sallie Mae’s face! Our interest rates just kept rising until it was at almost 10%…loan started at 3%!

Haha. Congrats on your snowman! And I think your order sounds about right. I would definitely feel an urgency to attack co-signed loans first. And if you find a way to throw your snowballs at Sallie Mae or MyFedLoan, I’d love to join in. 🙂

My husband and I are using the snowball method to pay off our debt monster. Like you guys, we really enjoy seeing the automatic benefits of paying off those smaller loans first. But we can also attest to the “life happens” as we just had to shell out $400 from a recently paid off credit line to pay for a vet bill. *womp womp* But we are still on the horse and we’ll get it all paid off (hopefully) by our target date of June 2014!

Life definitely happens. It always does. It’s almost as if the Debt Monster knows what’s coming and decides to throw hurdles in your way. Our major hurdle was a cross-country move the most expensive city in the land. 🙂 But it’s important to stay on the horse, even if that means lowering your debt repayment, which it sounds like you guys are rocking at. Here’s to June ’14!

I am trying to use the same method to stretch out my savings for school. Unfortunately, I am having a hard time working up the motivation, but maybe framing my thinking to minimize future DEBT will help me tighten up my wallet a little.

That’s the same way I feel about saving for retirement. We’re just going through the motions right now because the motivation isn’t there. But I’m sure it will mean more as our Baby Girl grows and we watch our parents enter their retirement years.

My husband and I were both very fortunate for finish school with no debt, which is honestly a miracle. My husband was blessed with a full ride football scholarship. I was blessed with parents who hopped on the Dave Ramsey train a long time ago and were able to help me pay for what scholarships wouldn’t. But I have seen great success through watching my parents change their finances as we were growing up. About a year ago they were able to celebrate the end of their house payments! It was huge as this was the last piece of debt my parents owed. Watching them go through the process of paying off debt and making wise financial choices has been very inspiring. And the best part is now I get to see what it looks like on the other side. They are able to give like no one else I know and they are some of the happiest people around. It is truly a blessing to be debt free and also have great examples of what life can be like if you make wise financial choices and get all of your ducks in a row while you are young.

Wow, what an awesome, amazing, inspiring story. Thanks for sharing. And congrats to you and your husband AND your parents for providing great examples.

I used an Excel spreadsheet to keep me motivated on paying down the mortgage. I love playing around with the numbers and see how extra principal payments can shorten the life of the loan. I’m currently paying $50 a month towards the principal and that will bring the 30-year loan down to 25 years. Woot!

We were all about the Excel spreadsheet. Those printouts came from it. I, like you, found a lot of joy fiddling around with the numbers and pushing our goal date up closer and closer. I’m not a huge fan of math, but I am when it makes my life easier. 🙂

I went with the largest interest rate because I did the math on the interest saved and couldn’t resist. I stayed motivated by using visuals on my whiteboard. It worked for me and I saved thousands in interest rates. The key to this is do whatever works best for you. The method is still the same regarding snowballing, but it just depends on the emotional aspect.

Totally agree. And the whiteboard visuals sounds interesting. I’m secretly hoping it was a photo of Hulk Hogan or The Rock flashing a face of pure intimidation. 🙂

We had a little insurance snafu and we piled up some hospital bills last year. We ended putting them on a credit card and then transferring to a 0% interest for the first year credit card. We’re paying that one off first, even though it’s not the smallest, because we don’t want to take a big hit come the end of the first year.

Great recap and I love that you saved your debt snowball!

Booo to hospital bills. Less about the money, and more about the fact that people had to be in the hospital. That was a smart temporary fix to avoiding the interest. And even smarter to be attacking that one first.

I probably need to file them away before Joanna “accidentally” throws them away.

I’ve never had the pleasure of owing multiple credit lines. I have an auto loan right now and a revolving credit card that gets paid off monthly…well…as long as the gas prices don’t keep going up jeez. I do sort of the reverse snowball for savings. As my truck gets paid off in June my payment will go straight to savings rather than checking. Also, all my raises that I get go straight into savings without ever even being realized.

I think that’s the last step to the debt snowball anyways. Take all that money you were paying down debt with and save it/invest it! Now only if we can only get that 12% Ramsey was talking about.

Haha. That 12% figure raised my eyebrows when I first read it. But I’m definitely not seeing those types of returns. Yet.

We went straight into the reverse snowball, too. It probably deserves its own step in the post.

I was surprised to see your recommendation of paying the smallest debt first. I’m glad you mentioned that “conventional wisdom” says to pay the debt with the highest interest rate. I get it that you liked the feeling of seeing the debt disappear, but it really does make most sense to pay of the highest interest rate debt first!

Well, recommendation is used loosely. We’re offering it up more as what worked for us. We needed to see those small victories to get some motivation momentum going. We also benefited from lower interest rates that were within 1-2% of each other. I’m sure if we had had a 3% vs. a 10% loan, we’d go straight at that 10% loan. But don’t underestimate psychology. A lot of folks don’t start or stop their debt repayment because they get overwhelmed by the perceived lack of progress.

Hi, I stumbled on your website thanks to Pinterest and I have to say, this post gives me hope! I cannot thank you enough for writing this post along with your others on budgeting.

Thanks for stopping by, Amanda! Know that there are a lot of “you”s out there who have made it happen. Like us. 🙂 Keep calm and budget on!

I’m a Dave Ramsey follower and totally agree with the debt snowball. We’re fast approaching our debt free time and we dream of calling in on the phone and screaming “we’re debt free!” Can’t wait for that! In order to pay off our debt, we live on one salary and use the other half for debt. We can do that because we live in a tiny home…. and sacrifice a lot… and budget like fools. We’re in our first year of marriage and I wouldn’t have it any other way. We’ve learned so much about each other… and all without TV!

I was not sure of getting a legit loan lender online because of the scams story i hear some years back. But when i could not face my Debt any more and my son was on hospital bed for surgery that involve huge money then i have to seeks for Assistance from friends and when there was no hope any more i decide to go online to seek a loan and i find Marian Lawson Loan company (marianlawson@outlook.com) with 2% interest Rate and applied immediately with my details as directed. Within seven Days of my application She wired my loan amount with No hidden charges and i could take care of my son medical bills and pay off my debt. I will advice every loan seeker to contact Marian Loan Company with marianlawson@outlook.com For easy and safe transaction.

I was destroying my student loans earlier this year when both my husband and I had jobs. I paid off 3 of my student loans and we were on track to being student-loan free by August 2016 and debt-free by December 2016. Then our vehicle decided to take a dump on us and my husband went from working full-time to being a student full time. I’m still paying more than the minimum payments for my student loans, we’re paying cash for my husband’s degree, and we are still building our savings. I feel more comfortable putting money into savings at this moment until my husband graduates and get’s a full-time job. It’s hard to limit yourself every month but it feels good to be (slowly) paying off debt and it feels REALLY good not to be taking on any MORE debt.

Dave Ramsey is awesome. He got us out of debt and his line of thinking has helped me budget everything.