The time is well overdue for an OFB update. Don’t give me that look. I know you’re giving me that look. Okay, okay, yes, we deserve the eye roll. And you’re right. This update is way, way, way overdue. Like WAY. Now that we’re square, let’s get back to the business of updating. Unlike a phone update that you ignore for six months, this one won’t take much time. And you hopefully won’t regret it afterwards.

Remember the post from October 26th, 2015, almost exactly four years ago? The one titled “So We Started a Business”? Well, this post could probably be called “And We’re Still Working on That Business.” Because that’s what takes up a very large portion of our time. We’re still super passionate about other things (like personal finance), but we also have to sleep (even if we’re only averaging 5 hours/night). But forget the chit-chat, let’s tell you what’s new.

We Added Another Tiny Human

It’s true. We are now a family of five! Our son, Jack, is almost a year-and-a-half, and we have felt every moment of that year and a half. Three kids tipped the scales into absolute chaos. On top of adjusting to three kids, we spent several months last year worrying about Jack’s health, which caused me to step away from our business while we focused on him. Long story short-enough-you-could-tweet it: he was born with his stomach in his chest (which isn’t good) so he needed to have surgery to move it back into his belly (which is good). He had a very rocky recovery post-surgery, but he’s doing really well now and thriving, which we are very grateful for.

We Bought a House

Remember all the times we talked about buying a house? Here and here, for example? Well, we finally did it. And since we can never do anything without a little bit of flair, we closed on our house three days before Jack was born. In some ways, it feels like we’re still getting settled in, but it is definitely starting to feel like home. We of course can’t wait to share what finally made us decide to buy, whether we stuck to our guns in putting at least 20% down, and a few other financial considerations we had when we bought our home. Like, even thinking about those posts makes me weirdly excited. Also, because of sentences like the former, we still have no friends.

We’ve Changed

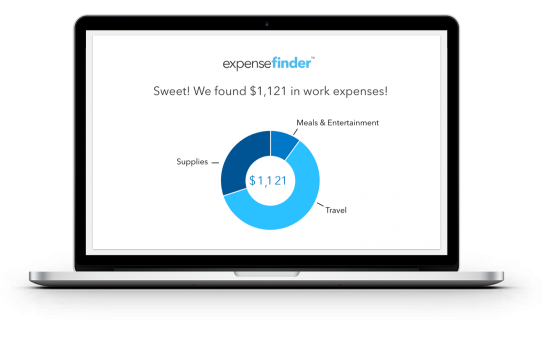

That sounds ominous, but I promise it’s not. Because running a small business is such a large part of our lives now, we feel like it wouldn’t be completely transparent for us to just talk about personal finance anymore. Yes, we still live and breathe personal finance with a fierce passion that would probably scare most folks. BUT we’re also just as passionate about being your own boss and using that to take control of your financial life. We used to spend an inordinate amount of our focus on saving money. And we’re still all about saving (sup, Taco Tuesdays). But we’re also all about finding new avenues to earn extra money and going after those. In other words, becoming the boss of your own life. That will look different for everyone, but we’re excited to expand on that topic more in the future.

It feels good to get those updates off our chests. We shared the biggest, most important updates, but we’ve got oodles (read: lots) of little topics we’re looking forward to discussing in the near future. We’re not sure if it will all live here on OFB or if it will land in a new virtual home since some of it will be completely unrelated to budgets (or “freaking budgets”). But the important thing is that right now we’re here. And you’re here. And we’ve got some good times ahead, promise.