UPDATE: We’ve updated this post! Check out our Best Budgeting & Saving Apps of 2016!

To help those 2013 financial New Year’s resolutions along, we’ve compiled a list of some of the best apps to help keep track of spending. We’ve already made our case for why smartphones are worth the dough (in our humblest of opinions), and these personal finance apps play a large role in that.

So without further ado, here’s our list of Best Personal Finance Apps for 2013…

NOTE: All apps listed below are for iPhone. We cannot speak to the availability or functionality on other phone platforms.

For everyday expense tracking

L: Easy Envelope Budget Aid // R: HomeBudget

Free:

Easy Envelope Budget Aid (4.5 stars)

This app puts the popular envelope budgeting system on your phone. Add some envelopes (budget categories) and add a transaction every time you spend. It’s simple, clean, and free.

Paid:

HomeBudget with Sync ($4.99 – 4 stars)

Everyone has a budgeting system that works for them. For Joanna and me, this is it. We swear by this app. The design and flow is intuitive and really easy to set up. And the fact that it syncs our account on both of our phones is super convenient.

For bill organization

L: Pageonce // R: BillTracker

Free:

Pageonce – Money & Bills (5 stars)

Show your bills who’s boss in 2013 with this free app. Pageonce provides a lot of the same great features as Mint, but does a much better job keeping track of bills and alerting you of any suspicious transactions. Score.

Paid:

BillTracker ($1.99 – 5 stars)

This is the easiest app to view your outstanding and upcoming bills at-a-glance. It features a helpful reminder system and includes an archive of past bills so that you can see your full payment history.

For tracking everything

L: Mint.com // R: Accounts 2 Checkbook

Free:

Mint.com Personal Finance (3.5 stars)

If you don’t have a Mint account, go get one. Now. This app automatically tracks everything on your phone: your bank accounts, credit cards, loans, spending, etc. It’s incredibly intuitive and it’s all in one place so you can easily see the big financial picture.

Paid:

Accounts 2 Checkbook ($1.99 – 4.5 stars)

This is a do-it-all daily finances app. It syncs between devices and automatically tracks your expenditures from your credit cards, bank accounts, etc. You can also transfer funds, store photo receipts, and print money (!)… OK, I made that last one up.

Worth noting

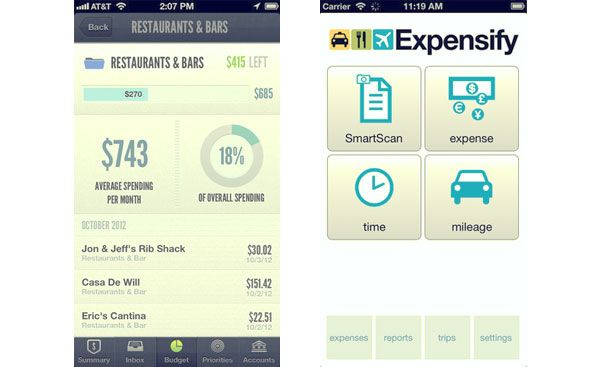

L: LearnVest // R: Expensify // Not pictured: Debt Free

Free:

LearnVest (5 stars)

With 5 stars and a clean, simple design, LearnVest is another solid alternative to Mint. With the app, you have the flexibility of adding transactions on or offline and can easily add cash transactions using geo-location. Pretty spiffy.

Expensify (4 stars)

This is the ultimate app for business travelers. Expensify helps to automate the expense report process and has an awesome receipt scanning function. My problem with receipts is well-documented, so hopefully I’ll use this app more frequently in 2013.

Paid:

Debt Free – Pay off your Debt With Debt Snowball Method ($0.99 – 5 stars)

Ready to slay your debt with the snowball method? Here’s your answer. This app helps you organize and keep track of your snowball progress. It includes a payoff date calculator so that you can set a target “get the heck out of debt” date.

Conclusion

Now if only there were a financial app that used Siri. Who wouldn’t love hearing in that lovable voice of hers, “DebtSlayer, you are $25 over your food budget this month. Stop eating.”?

Any apps you’d add to this list? How do you feel about paying money for an app that’s supposed to help you save… money?

—————————–

(Original photo by williamhook)