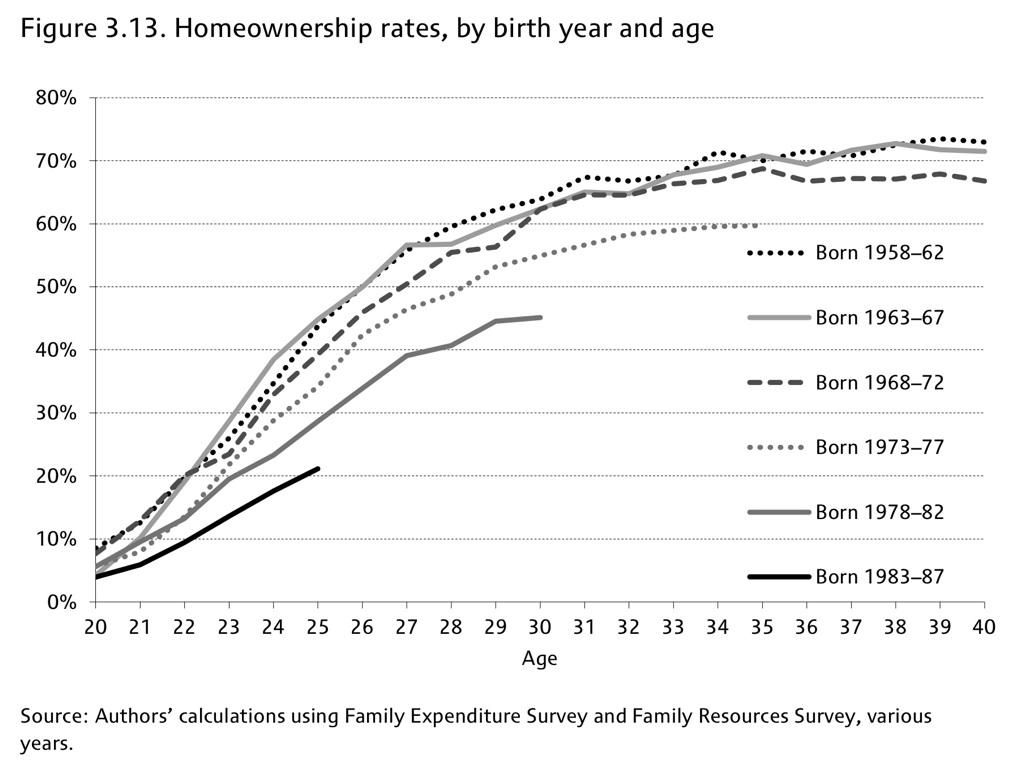

Johnny and I found this graph pretty interesting, so we wanted to share. As you can see, the age for home ownership seems to be going up. The percent of young people who are homeowners today is much lower than the percent of young homeowners a few decades ago. So is this a good thing or a bad thing?

As current renters, maybe it’s obvious how we feel about this graph. We’d like to think it’s a good thing. The reason we haven’t bought a home yet is that we want to make sure the timing is right and that we have all of our financial ducks in a row. We’d like to tell ourselves that the graph simply indicates that all of our peers are in the same boat as us.

But deep down, I’m thinking it’s not as simple as all that. Could it be that our generation isn’t finding stable jobs/incomes, that we’re not financially responsible enough for home ownership, or even that we’re just taking longer to grow up? Or has the cost of homes simply gone up more than our incomes have?

Whatever the case, we’re still leaning toward it being a good thing, rather than a bad thing. We’re all for taking our time to settle down and making sure we’re really ready to pay six figures for something. What are your thoughts? What do you think this graph says about the current generation?

34 Comments

This is super interesting. Honestly, it could be many things. It could be the job market, like you said, the massive student loan debt that many younger people are finding themselves saddled with, or the fact that older generations had to go out on their own at a younger age. When you’re married at 15 or 16, of course you’re ready to buy a house when you’re 21!

Very true! I wonder if that’s the biggest factor!

This would seem to correlate well with a few things: 1) younger generations getting married later and having children later 2) people moving from employer to employer much more frequently–less near-term stability for hopefully more upside down the road and 3) in the internet/social media-age there are so many more Joneses to keep up with. I think constantly seeing photos of “friends” partying, traveling, or doing other cool stuff makes people think this is normal, and they should be able to afford it and do it as well. So they end up devoting their dollars to similar activities (and of course sharing photos or updates about it along the way) instead of socking those dollars away for a down payment on a house (boring). Just a theory…

Great points. I think all of those are major contributing factors. I hadn’t thought of the keeping up with the Joneses one, but you’re right that the social media-age makes it more of a struggle to not compare and to live within our means and save.

I agree I think a lot of people now a day just want a different life style. I wouldn’t even say its a job thing or a lack of financial responsibility ( though I sure PLENTY of people do fall in there).

I think people just have their own ideas of what life is about. Not the standard go to school, go to college, get a job, get married, have kids, buy a house, work forever , then retire. BLAH!

No i think most young people now a days love to travel or move around and there for a house might just not be a goal.

We are not home owners 27 yrs old. but my husband has the home ownership itch and we will buy eventually, but we want to have the 20% to put down

i personally would rather have a tumbleweed house and move around a bunch

This trend change looks a lot less drastic than the media has made it out to be. It looks like home ownership rates at a given age have been dropping for generations.

They’ve definitely been dropping for generations, but our generation is significantly lower than any previously.

I don’t look at it as a good or bad thing. I do think that the mindset of our (I’m 30 and a homeowner) has changed from our previous generations. I look at it similarly to car ownership rates, which have dropped in recent years, and that younger individuals are tied to their phones and social interactions more so than physical items like homes and cars. Employment, student loans, etc may be a factor as well, but I do not believe them to be the over-riding item.

It’s not doom and gloom for the economy (as many news outlets will say) because the economy is adaptable and is changing every day, regardless of whether or not people buy homes.

I like your outlook, Richard, and I agree that it doesn’t necessarily mean anything about our economy. The culture of our generation is simply different than those before us.

I agree that it’s probably not all doom and gloom, and that it’s not a bad thing. In fact, it’s not necessarily a good or bad thing, but just the way it is in the world. As Emily pointed out, home ownership in your 20s has been trending down anyway, not just in our generation. Given the high cost of living in many cities, the recession just when we left college, and high student loans, I am always surprised when I hear of people in their early 20s buying a home. But good for them if they’ve saved up that early. We’re waiting until we have 20%, but with home prices, that has already been a few years of saving…

You’re telling me. I don’t know when Johnny and I are going to feel comfortable enough with our savings to finally pull the trigger on homeownership!

Hmm, interesting. I was born 1985 and I’m 29 and single and probably won’t be ready to buy (on my own) for a few years-2-4 years away. Interestingly, my parents were born in 1946 and bought their first home around age 36. Even though they bought at age 36 (later than some) , they had it paid off at age 54. So, if you haven’t bought until later in life, don’t fret–you’re not necessarily “behind.” My parents also had their first child (me!) at 38, and guess what? It all worked out. Moral of the story: don’t worry too much about comparing yourself to your peers, as these charts sometimes cause people to do! 🙂

Smart words, Melanie! You’re totally right.

We were 27 when we bought our first home. There are many key elements to look at. Part could certainly be that it isn’t straight forward or necessary to own a home. If you can rent cheaper than buying and save prodigious amounts, you will still win. Some do make good money on their houses over time. I like to think of it more as a place to live.

I think the “permanence” of home ownership is a tough one. It really does tie you down and mortgage you. Buying a “just the right size” house and not borrowing too. much are my key wins. 15 or 30 years is just so long. In the end, do the research and buy only when ready.

Interesting… maybe it isn’t as necessary to buy a home anymore. And people are so much more transient these days that renting is easier and more appealing.

Here’s another thought: maybe our generation wants more and bigger at a younger age, but they can’t quite afford it as early as they’d like (contributing to the later home ownership age)? Just an idea, in addition to the others already mentioned. Most of my peers seem to think they need now what their parents have after 20+ more years of working. We bought our 1200 sq ft home at ages 24 and 27, putting 20% down. Many people our age have mentioned what a great “starter home” we have. Did our grandparents even know the phrase “starter home”? Doubtful. (look into increased home prices after WWII – it’s crazy) We have our only other bedroom set up for 3 children (we will be foster parents next month!), we have 2 bathrooms, and no mud room, formal dining room, or laundry room. If we can’t be satisfied with little, a McMansion with more bathrooms than family members won’t do the trick. So while I’d like to see this chart as the glass half full…it seems to me another indication of the entitlement and dissatisfaction so rampant in our generation.

Love your thoughts, Taylor! I think you’re spot on. It’s so, so true!

And very cool on becoming foster parents! I hope all goes well!

Well, personally I would tend to think that it has much more to do with the housing bubble and subsequent crash than anything intrinsic to younger generations. It used to be that buying a home was pretty much a fool-proof investment. Unless you did something really stupid or got really unlucky, you could pretty much count on your home increasing in value, and increasing quite substantially. When I bought my house back in the mid-1990’s, the common wisdom was that if you were gonna hold onto it for at least 5 years, buying was a much better deal than renting. And even if you had to sell before then, you could easily just roll the equity into your next house.

But younger generations came of age during the psychosis of the sub-prime lending debacle. I mean at first house values were skyrocketing beyond all reason, so a first time buyer could easily get priced out of what would have previously been a reasonably priced “starter home.” Then the market crashed and y’all had a front row seat while thousands upon thousands of people lost their homes, saw their mortgages go under water, and really lost their financial shirts. And don’t EVEN get me started about crazy shit like ARM’s and interest only mortgages. None of that stuff even existed when I bought my home… or if it did, it was certainly not something that anyone but the foolhardy would venture into.

I dunno… if that had been my experience I think I’d have been pretty darned cautious about jumping into the housing market too.

Very true… I’m sure those factors have made us much more wary! Really enjoyed your thoughts!

I think it’s a mixture of both but probably more negative than positive. I think the cost of living is just too high and our generation is saddled with student loan debt. We would love to be homeowners and are trying to save up as much as possible as quickly as possible so we aren’t timed out of the market again. But we spent the past several years building up our careers and paying off our debt

Agreed. Our generation has a lot of other financial obligations that makes it tough to finally become homeowners.

Where we live, house prices have wayyy outstripped incomes. We’re also struggling with unemployment and that has been a big setback.

Depending on which part of the US you live, those are both big factors here, too. There are a couple cities where Johnny and I would be renters our whole lives.

This is an interesting chart. I’ve seen some articles lately discussing how ‘irresponsible’ the younger generation is, how they live at home longer and aren’t doing all the so-called ‘grown-up’ milestones until later. Personally, my education got in my way. I spent longer in school, which delayed house buying and baby-having. But, I have no regrets. Sometimes I worry that people in their early 20s are pressured into finding their dream career, and true love and settling down. I think just because that worked for early generations, there is nothing that says that is the best way. As long as those younger folks aren’t completely goofing off and living off of their parents or the government, I think its perfectly okay for some people to slow down and enjoy life more before taking on massive adult responsibilities!

I think this is definitely reflective of the fact that our generation does almost everything later, (graduation, marriages, babies, careers, etc.). But I also think that the housing market you live in can make a huge difference as well. In the medium size town I live in (Texas), a one bedroom apartment is around $1000/month in rent and a 3 bed/2 bath rental house is closer to $1500-1600/month. Whereas the monthly mortgage payment on the same size house (with taxes and insurance included) sits right in the middle of those two figures. Granted, it’s also one of the most affordable housing markets in the country, so when younger couples are deciding whether to rent or buy, home ownership seems like a much more reasonable option. I think the general attitude is “Why cram your life into 800 sq ft or ‘throw away’ money on rent when you can live in a generously sized home for not much more than you rent and have the benefits of home ownership?” Not saying this is good or bad one way or another, there are definitely pros and cons to both, but it makes it easy to see why buying a home when you’re younger, and can truly afford it, (key point being that you can really afford it) isn’t always a bad thing. I think it just depends on your individual circumstances. But, with all of that being said, we own and we love it but we also plan on kissing that mortgage goodbye and never having one again.

I’m obviously not the “norm” but my birth year (1990) doesn’t even fall on this graph. I’m single, 23, and closed on my home a few months after turning 21. I just could not get over the fact that I was paying more in rent than I could for a house payment, having nothing to show for it at the end of the year. I did not have any financial help from family or friends, but did get a loan where I didn’t need a downpayment. I live in Indiana, where the housing market was definitely a buyer’s market at the time. Right before my lease was up, I decided to see if I could get a mortgage approval. I did and quickly toured 12+ houses and looked at way more online listings. I got approved in October and closed mid-December. I got a deal; paying $28,000 less than the listing price and the seller was responsible for all closing costs. It appraised at more than $30,000 of what I paid and is currently tax-assessed at around $40,000 above that. I ended up saving hundreds of dollars a month by buying vs renting. My 900 sq.ft. apartment was well over $750 a month and my mortgage is about $200 less than that, in a 1300 sq.ft home. One of the major points I learned is that just because the bank says they’ll give you a $200,000 mortgage does NOT mean you should take the full amount. I took less, got an amazing interest rate, and haven’t looked back yet!

Here’s my perspective from the residential mortgage industry and our nation as a whole.

First / Our Government FORCED the banks to start lending to NON-credit worthy people in the early 2000’s. Remember President Clinton’s passionate message that, “The American Dream of home ownership should be made available to everyone in America!” That innovative idea, still is a recipe for financial DISASTER that ruined the public’s confidence in the one stable place you could put your money. your home. The American public has been financially hurt or even ruined by our Government’s policy making based on “Fairness” instead of financial and personal responsibility. The American people have little TRUST and much uncertainty in our real estate sector.

2nd / People have no money for a down payment. The savings rate of our nation is at an all time low. Just look at our government who borrows 40% of every dollar spent. We owe $17.7 trillion and have no plans on paying it down nor do we plan on having a balanced budget. The message is loud and clear that it is better to spend today and worry about finances later. Agreed?

3rd / Education & Access to Information / Has anyone ever taken a course explaining your credit and how it is calculated? I bet no one has. The reason is that there is no course to explain SPECIFICALLY how our credit is calculated. If you have access to the matrix or algorithm for credit score calculation, please send it to me. The credit bureaus and the banking industry are partners with the Federal Reserve System and Treasury Department in controlling access to their financial monopoly. It is a huge system that does not provide access to John Q. Public regarding calculating credit scores, the reporting of credit scores and why short sales are coded on credit reports as Foreclosures.

If you do own a home and you think it is worth more than you owe, (underwater homeowner) try calling your servicer (who you pay your monthly mortgage payment) and ask if they will allow you to sell your home for less than what is owed.

It is against the LAW for the banks to require anyone to be late on their mortgage in order to allow a short sale. The guarantee the customer service person will tell you, Mrs. Jones, we can’t allow a negotiated short sale because you are not currently past due on your mortgage. Once you are 120 days late is when we will talk.

The banks flatly deny this practice exists when questioned by the Consumer Financial Protection Bureau or CFPB.

Reform is needed but the entrenched administration of our government and corporations are making life very hard for individual Americans.

Thanks for letting me rant and vent today, I fell much better.

All my best,

Jimmy Mac

Very interesting. The graph correlates with my anecdotal knowledge of home owners. My husband and I (both in the born 83-87 group) own our home, but not many of our friends do. I think it’s absolutely related to nationwide trends of later marriages, delayed careers (due to grad school or the incredibly tough job market), and also a reflection of our generation’s interest in travel and diversity of experiences. I know a lot of folks who just aren’t ready to commit to home ownership–from a financial or emotional perspective. Thanks for sharing this!

I’m in my early 30s and purchased a home with my common law partner two years ago.

While there a few people that purchase homes by themselves, most people buy an actual house with someone else who they’re in a serious relationship with. Not everyone meets the love of their life in college or right out of college and is able to buy a house a few years after.

I met the love of my life in my late 20s, thus it made perfect sense that we would buy a house in our early 30s. We all know how much of a big financial commitment it is, so you want to make sure you’re with the right person before you buy it.

I try not to put a lot of stock into what I “should do/have/buy/want” according to my age. When I should have been living it up in college I had to work full time instead. Most people my age are just settling into their career (after job hopping) when I’ve been in mine for over 18 years… Which represents more than half my life!

I think you hit the nail on the head about incomes not rising as sharply as home prices, plus people pursuing more education for longer (in hopes of getting a better income), rising student debt, rising healthcare costs and in my case I would hate to be trapped in a home when an amazing job opportunity comes up.

I think every couple/family has to base their choices on what works for them…not the shoulds!

I think it’s because wages haven’t kept up with inflation; meaning a housing purchase is much more of a person’s income percentage = wise than it used to be. I think a graph that shows how much of a persons/ families salary is devoted to things like housing historically would be interesting.

Personally, I think today’s younger generations don’t want the work that is associated with a home. Free maintenance, bug spraying, and even doorside trash pick up services are at apartments now. Especially down in Dallas, where you can have a pool without the maintenance. Dallas has a different lifestyle too, where younger people would rather spend their money on booze than saving up and caring for a home. We on the other hand enjoy working on our home, and take pride in owning it!

There’s so much more to think about when buying a home than just the money. On the one hand it’s an emotional decision and I understand the home-building instinct, particularly when you’re thinking about starting a family. But with all your money tied up in one asset, what happens if you need to make a change? If you lose your job and find a new one in a different state? Or if property prices fall instead of rise? Personally, I’m too young to settle down in one place at the moment and I value my flexibility to move around, so if I were to buy a house anytime soon, it would be as an investment rather than as a place to hang my hat.

As a real estate agent I often tell people, “There’s nothing wrong with renting!” (Gasp!) Whether it’s your personal preference, or financial situation, or the market, or whatever: it’s okay to rent! We often have such a stigma against renting for some reason & it’s a shame. We shouldn’t have to feel as if we’re lesser beings somehow for renting. By the same token we shouldn’t feel superior because we own a home either. Home is where you hang your hat. Period.